*Availability is subject to factors outside of Visa’s control, including participation by issuers, acquirers and merchants.

-

Installments: Consumers can buy now and pay later

Offer your customers installment payment plans on an API-based solution or on existing international standards.

For more information on Visa Installment, visit the link below

Visa has developed installment solutions

Visa has released capabilities on Visa Developer Portal to allow clients to develop and pilot installment experiences to offer to their customers.*

Introduction to installment payments

Installment payments (installments) refer to the option to pay for purchases over time by dividing the purchase amount into smaller equal payments. Consumers will typically use installments to buy medium and large ticket items (e.g. electronics, furniture). But in some markets, they may even use them to make everyday purchases (e.g. groceries, retail). So, what’s the key benefit for consumers with installments? They get to spread their purchases, including transparent fees, into periodic (usually monthly) repayment amounts.

The following example shows how installments payments work for a large ticket purchase of $800 paid for over 4 months, 0% fees:

Paid $200

1st installment

Paid $200

2nd installment

Paid $200

3rd installment

Paid $200

4th installment

Common installment payments models

There are three primary models in the global installment payments landscape: Pre-Purchase, During Purchase and Post-Purchase. These models differ by when the consumer is offered installments, who presents the installment payments plan, and who pays for the cost of providing credit.*

*Financial institutions are solely responsible for its own installment program.

Pre-purchase

Consumer opts-in for installments pre-purchase

During purchase

Consumer prompted at merchant checkout to pay with installments

Post-purchase

Consumer converts a recent card transaction into installments

Create plan

API for issuers to create installment plans. Issuers to define plan attributes such as:

- Duration of installment loan

- Participating merchant and cards

- Interest and fees

Check eligibility

API for acquirers, technology pltforms and merchant to look up eligible installment plan(s) for an installment transaction. Merchant can display eligible installment plans and costs to a cardholder during purchases.

Select plan

API for merchant to confirm the cardholder selected installment plan for a given transaction.

Convert plan

API for issuers to convert the original transaction into an installment plan.

Schedule plan

API for issuers to schedule payments of installment transactions The service will look up cardholder status and calculate monthly installment payments due, so that issuers can manage general ledger and post to cardholder statement correctly.

Visa’s installment solution can provide benefits for all parties in the ecosystem

Note: Depicts conceptual vision in development; features, functionality, availability are subject to change. Issuer is solely responsible for its own installment program.

Installments is a large and growing opportunity

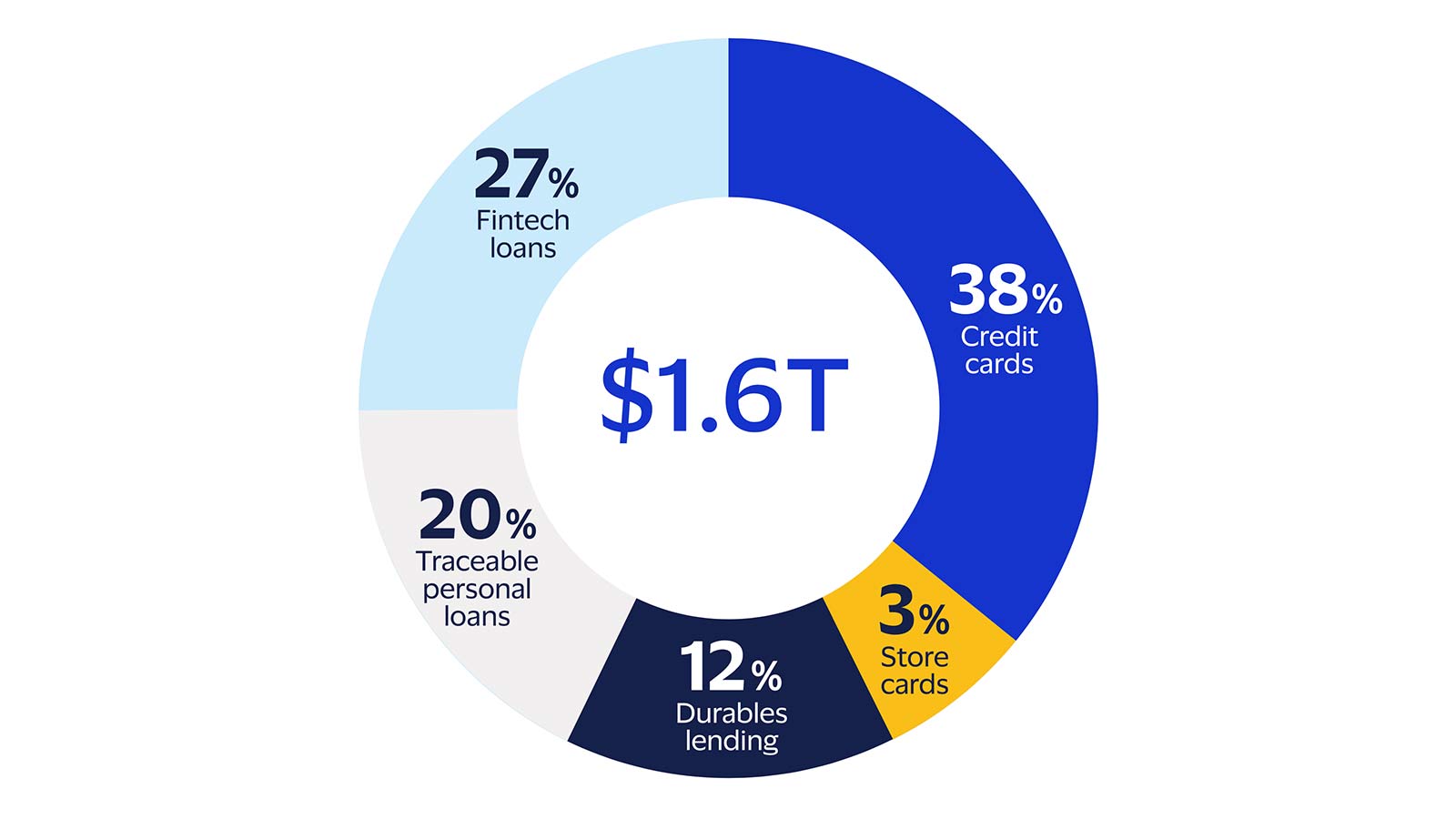

Globally, installments represented $1.6T in market value in 2020. And it’s growing quickly - up 5% YoY. In contrast, credit card expenditure declined by 4% globally.

Global installments market size

Note: 2020 global installments market size ($1.6T) excludes $1.02T in untraceable installments volume (e.g., “debt consolidation”). Growth in global installments and credit cards shown as year-over-year increase in payments volume in 2019 vs. 2018.

Source: Visa commissioned study performed by Euromonitor September 2021